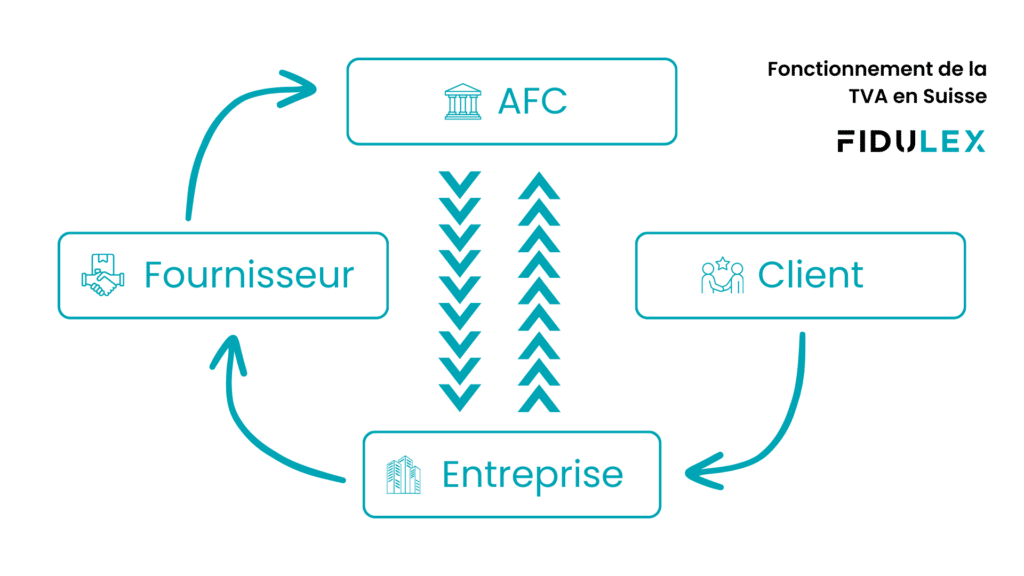

How Swiss VAT works

What is VAT?

VAT is an indirect tax levied on the consumption of goods and services. It is paid by the end consumer, but collected and remitted to the tax authorities by businesses. In Switzerland, VAT is governed by the Federal Law on Value Added Tax (LTVA).

History of VAT

Introduced in 1995, Swiss VAT replaced the old sales tax. Since then, it has evolved to adapt to economic needs and international directives, notably those of the European Union. Almost every country in the world has a VAT system, with the exception of certain countries such as the United States and the Cayman Islands.

Legal Basis

The LTVA is the main legal basis for VAT in Switzerland. It governs the principles of tax liability, VAT rates, input tax deductions, reporting and payment obligations, as well as penalties for non-compliance.

The OTVA clarifies and supplements the provisions of the Value Added Tax Act. It details the administrative procedures, the forms to be used, the deadlines to be met and the specific features of certain business sectors.

In addition, theFTA's website regularly publishes guidelines and circulars which interpret and clarify the legal provisions governing VAT.

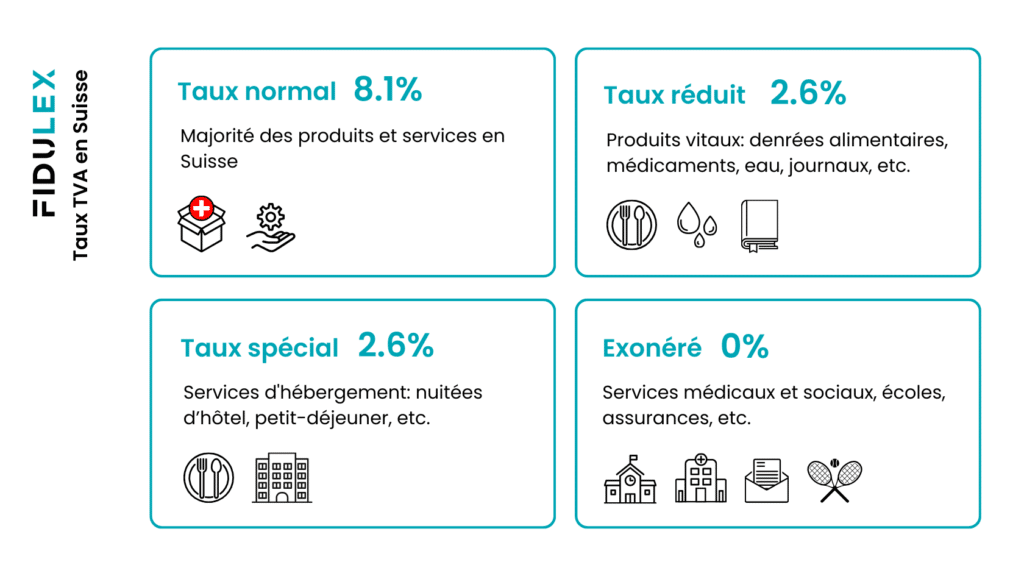

VAT rates in 2024

VAT is levied on a wide range of products and services at a standard rate of 8.1%. However, certain activities are subject to a reduced or exempt rate.

Standard rate

Most products and services in Switzerland are subject to the standard VAT rate of 8.1%.

Reduced rate

Certain products and services are subject to a reduced rate due to their useful nature. The following services are subject to a rate of 2.6%:

- Food and water

- Livestock, poultry and fish

- Pet food and litter

- Fertilizers

- Medicines

- Newspapers and books

The full list is available on the AFC website.

Special lodging rate

To support Switzerland's tourism and hotel sector, VAT on accommodation services is subject to a special reduced rate of 3.7%. The special rate for accommodation applies to services such as :

- Room rental in hotels, motels, guesthouses

- Accommodation on campsites and caravan sites

- Related services directly linked to hosting

Exempt

Companies with annual sales not exceeding CHF 100,000 are exempt from VAT registration. For non-profit associations and foundations, the threshold has been raised to CHF 150,000. However, these small businesses can choose to voluntarily register for VAT.

Separately, certain transactions are exempt from VAT in Switzerland. Here are some of the most common:

- Medical and paramedical services

- Education services (schools & universities)

- Social services

- Real estate transactions

- Financial Services

- Insurance

- Postal services

- Cultural and sports services

Exempt

Goods and services exported are exempt to avoid double taxation and promote Swiss exports. Companies can sell their products and services abroad without Swiss VAT, which will be added in the country of import.

VAT statement

The VAT statement is the process by which a company calculates the difference between VAT collected on sales and VAT paid on professional purchases. Settlement is generally made on a quarterly or half-yearly basis, depending on the company's sales.

There are two main counting methods :

Effective method : Used mainly by medium-sized and large companies, this method requires accurate declaration of input and output VAT on every transaction.

Net tax debt rate method : Suitable for small businesses, this method simplifies the process by applying a flat rate to sales to calculate the VAT due.

Procedure for deducting VAT

1. Calculation of amounts

The first step in settling VAT is to assemble the sales and purchase invoices (input and output VAT respectively) for the settlement period, in order to calculate the VAT due on sales and the recoverable VAT on purchases.

2. Fill in the settlement form

Use the official form from the tax authorities for report input and output VAT amounts. Different forms are available, depending on the method chosen (effective or net tax liability rate).

3. Sending the declaration

The declaration can be made online on the portal of the Federal Tax Administration with VAT statement Easy or Pro.

4. Payment or refund

If input VAT is higher than output VAT, the company must pay the difference between the two amounts. difference to the tax authorities. If the deductible VAT is higher, it will request a reimbursement.

VAT registration

- Extract from the Commercial Register and IDE number

- Social insurance number (simple company not registered with the RC)

- First-year sales (or estimate)

- Tax representative for foreign companies

VAT certificates

Certificate of registration

Company certificate

VAT payment certificate

VAT liability

Who is liable for VAT?

- Public limited companies (SA) and limited liability companies (Sàrl)

- Sole proprietorships and SnC

- Non-profit organizations engaged in commercial activities

Exceptions and exemptions

It should be noted that the main criterion for VAT liability is annual sales: companies with annual sales in excess of CHF 100,000 from services subject to VAT are subject to VAT. However, for associations and foundations the threshold is set at CHF 150,000.

Companies with sales below these thresholds may choose to be subject to voluntarily to VAT.

As mentioned, certain activities and services may be exempt from VAT, even if they exceed the threshold, as in the case of medical and educational services, for example. In addition, exports are exempt from VAT (it will be paid in the importing country).

Frequently Asked Questions

How do I complete a Swiss VAT statement?

To complete a Swiss VAT statement, please follow the steps below:

1. Calculation of amounts :

Gather sales and purchase invoices to calculate VAT due on sales and recoverable VAT on purchases.

2. Fill in the settlement form :

Use the tax authorities' official form to declare the amounts of VAT collected and deductible, depending on the method chosen (effective or net tax liability rate).

3. Sending the declaration :

Make your declaration online on the portal of the Federal Tax Administration via VAT Statement Easy or Pro.

4. Payment or refund :

If output VAT is higher than input VAT, pay the difference to the tax authorities.

If deductible VAT is higher, ask for a refund.

How is VAT calculated in Switzerland?

To calculate VAT in Switzerland, follow the steps below:

1. Identify the applicable VAT rate:

- Standard rate (8.1%)

- Reduced rate (2.5%)

- Special rate (3.7%)

2. Calculate VAT collected

VAT collected = Sales price excluding VAT × VAT rate

Example: for a product costing CHF 100, VAT will be CHF 8.1.

3. Calculate input VAT

Deductible VAT = Purchase price excluding VAT x VAT rate

How do I get a VAT number?

To obtain a VAT number, also known as an IDE number, you'll need to be registered with the Registre du Commerce in your canton. Then submit an application via the FTA portal.

How to reclaim French VAT in Switzerland?

To reclaim VAT paid in Switzerland on the purchase of goods or services, your company can apply for a refund via the form 3559 SDavailable from the French tax authorities.

The conditions for obtaining a refund of French VAT in Switzerland are as follows:

- Not be subject to VAT in France.

- Not have a registered office, permanent establishment or domicile in France.

- Use goods and services purchased for activities subject to VAT in Switzerland.