Accounting services in Geneva

Are you looking for a practical and efficient way to manage your company's accounting? Fidulex offers an accounting service in Geneva tailored to your needs, in paper or 100% digital format.

We help companies to improve their accounting and strengthen their financial performance.

Your accounting firm's services

Looking for a practical, efficient way to manage your accounts? At Fidulex, we put customer satisfaction first. Up-to-the-minute accounting for the smooth running of your business.

Regular accounting

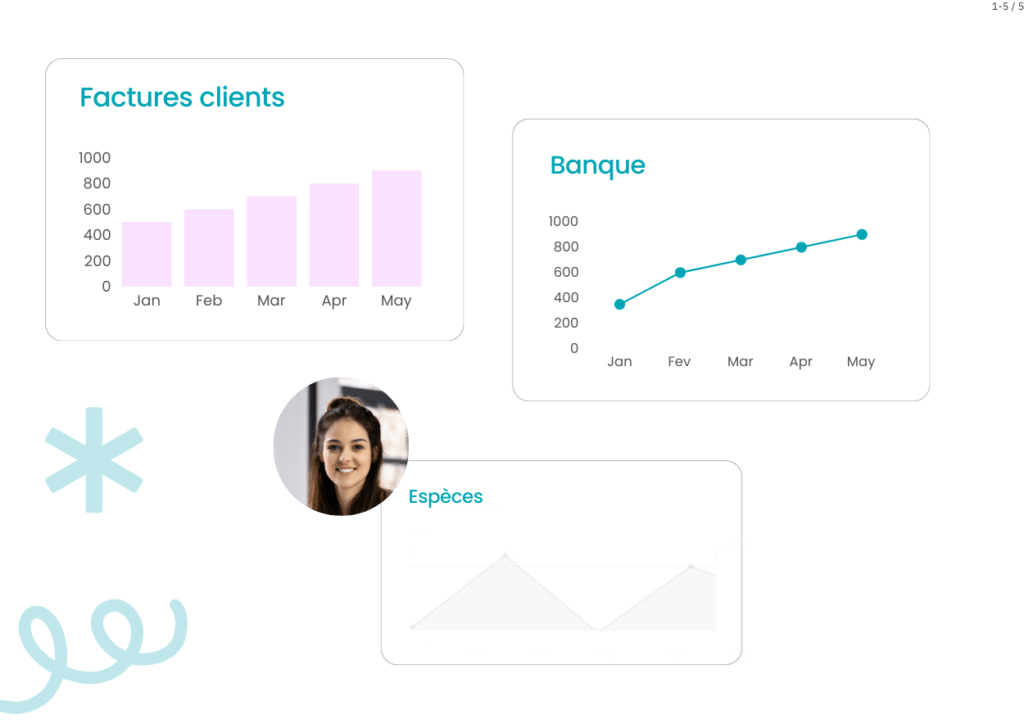

Your accounts are kept on schedule (weekly, monthly, quarterly). Our accountants ensure that all transactions are properly documented.

Accounting software

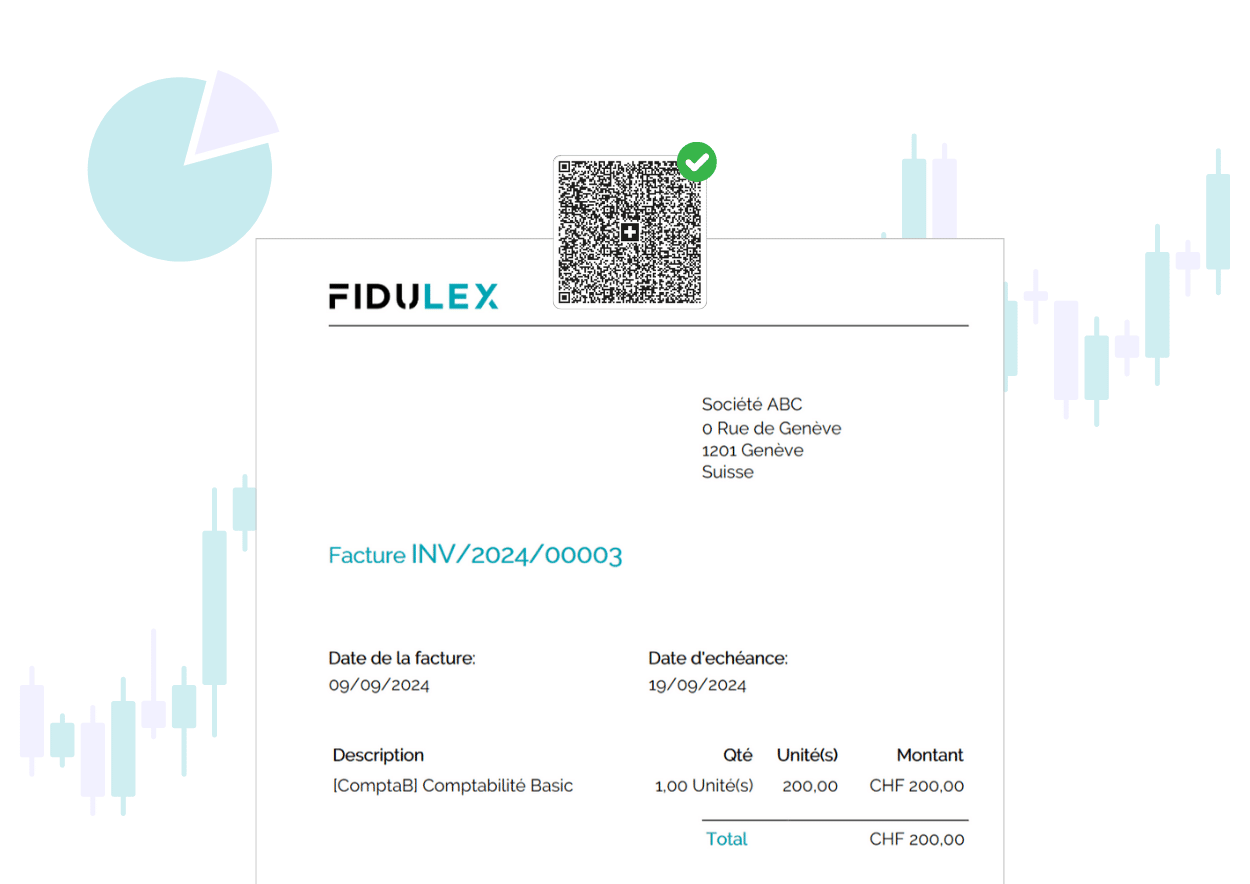

Upload your documents, view your expenses and income, and generate your QR invoices, all from a single space, accessible from all your devices.

Personalized follow-up, dedicated accountant

Your accountant will work closely with your company throughout our mandate. This way of working means we can react quickly, which is much appreciated by our customers.

Customized solutions

Monthly financial reports, payroll management, tax optimization, or advice on demand? We adapt to your company's needs.

Let's discuss your needs

Our experts are available to meet with you online or in our offices to discuss and define your business accounting needs.

360 account management

One of the key objectives of Fidulex's accounting department is to ensure that complete outfit of your company's accounting. This service includes recording financial transactions such as receivables, payments, overheads and much more.

Our qualified accountants ensure that all these transactions are properly documented and filed in the appropriate books of account.

Preparing tax returns

The preparation of periodic tax returns is also included in all our accounting subscriptions. Our chartered accountants are responsible for in-depth analysis of all tax aspects to ensure full compliance with current legislation. They also prepare and submit these returns on time, avoiding any risk of penalties.

Cost accounting

Our chartered accountants scrutinize your financial statements, identify trends and opportunities, and provide detailed reports on the company's financial health. This information helps identify potential areas for improvement and develop strategies for sustainable growth.

Billing software

Generate QR invoices directly from your customer area. The QR code contains all the information required for payment, speeding up transactions and reducing errors. QR-invoicing also saves time and effort by eliminating the need for manual invoice generation or data entry.

Discover our accounting packages

Whatever your needs, our trustee offers you several modular plans to best suit you and your company.

The rates shown below are provided as a guide only. They may be subject to change depending on your requirements and the volume and complexity of the work to be carried out.

Basic

Optimal

Premium

Extras:

A delay in your

accounting? We've got you covered.

Frequently asked questions

An outsourced accounting service offers several advantages, such as easy access to financial information, reduced costs associated with hiring an in-house accountant, and the possibility of benefiting from specialized expertise in Swiss accounting, tax and social regulations.

- Manage cash flow and control expenses and revenues.

- Analyze performance, loads and profits on an ongoing basis.

- Facilitates compliance with legal and tax obligations.

- Quickly detects errors and potential fraud.

- Facilitates funding applications to partners by providing reliable, up-to-date financial information.

The financial accounting is to provide financial information. It focuses primarily on the recording of financial transactions, and the preparation of financial statements such as the balance sheet, income statement and cash flow statement.

The management accounting is focused on the internal use of financial accounting information with a purely economic approach. It is a tool for decision-making and strategic planning.

In Switzerland, companies are subject to certain legal accounting requirements. These obligations vary according to the company's legal form and size.

Companies must keep accounts and draw up annual financial statements (balance sheet, income statement and notes).

In addition, supporting documents must be kept for a minimum period of ten years.

Finally, certain companies are required to have their accounts audited by an approved auditor if they exceed certain thresholds in terms of sales, balance sheet, income statement or number of employees.