Introduction

Setting up a business is an exciting adventure that requires courage. Switzerland attracts many entrepreneurs because of the country's economic stability, qualitative infrastructures and a pleasant economic environment. Moreover, Swiss taxes can be considered attractive compared to other European countries, making it an excellent choice for starting a business.

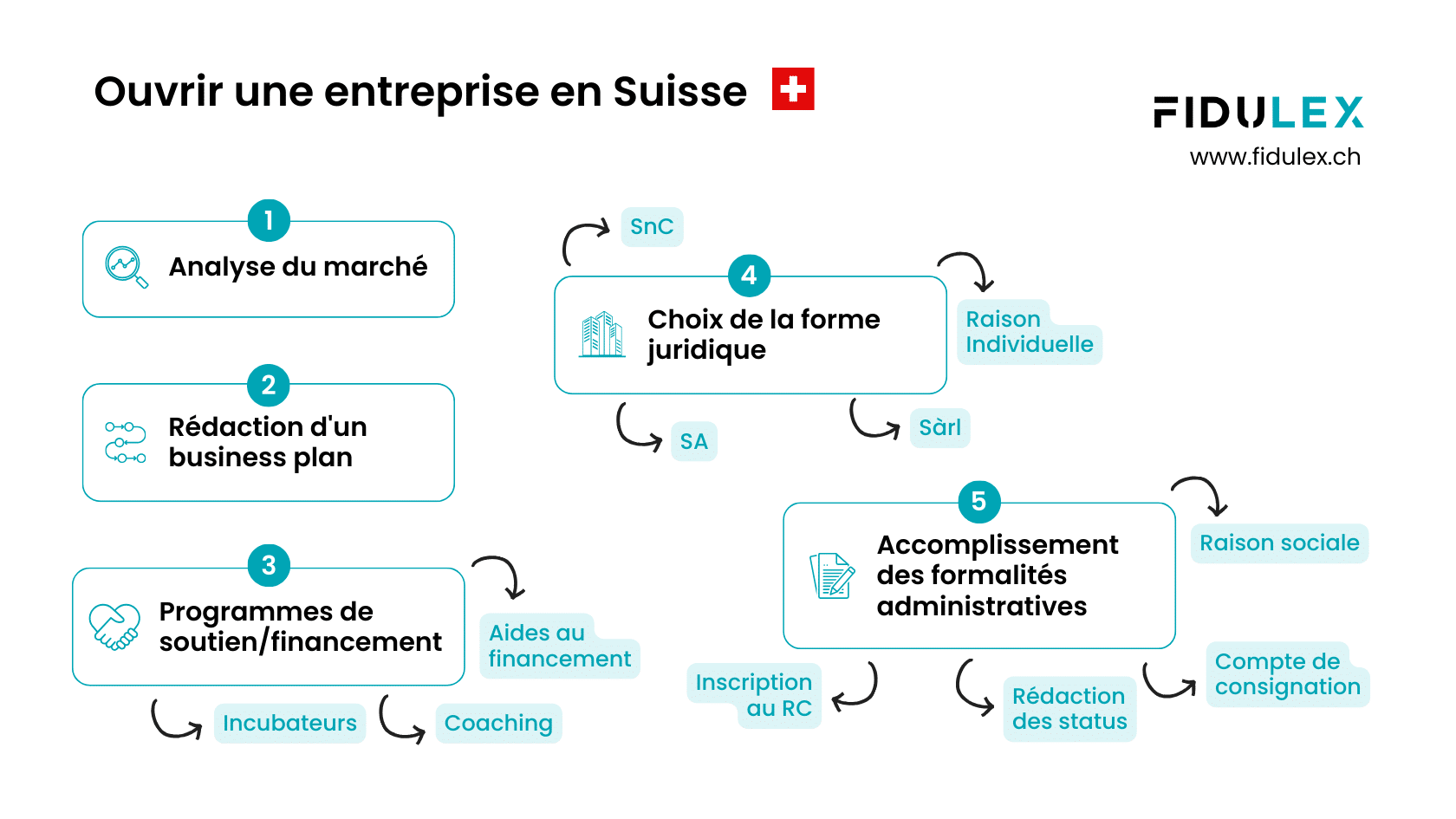

Whether you're a Swiss resident or a foreign entrepreneur, in this guide we take you through all the essential steps for launching your business in Switzerland, from market analysis to registering in the commercial register, choosing your legal form, managing insurance and much more.

Market Research and Analysis

Market research will help you understand the financial needs of your potential customers, evaluate the current state of competition, and determine the viability of your project. You can collect data via surveys or secondary sources, then interpret the results to identify trends. Testing your idea on a small scale with a sample of consumers can also provide good feedback before the official launch.

Steps to Successful Market Research

- Define your target market: Identify exactly who your customers are. What is their demographic profile (age, gender, income, etc.)? What are their needs, expectations and buying behaviors?

- Competitive analysis : Study the companies already present in the market. What products or services do they offer? How are they positioned in terms of price, quality and reputation?

- Data collection : Collect data via interviews, focus groups, the Internet or specialized statistics platforms.

- Interpreting the results : Analyze data to validate hypotheses and discover trends.

- Test your idea: If possible, carry out a market test by launching a beta version of your product or service. This will enable you to obtain real-time feedback and adjust your offer before the official launch.

Drawing up a Business Plan

A business plan is optional, but it can help you clarify your product or service, as well as short- and long-term objectives... It is sometimes mandatory, for example, when applying for a bank loan or pitching to investors.

The business plan requires an in-depth analysis of the market, the competition, and the financial aspects of your project. This helps you assess the feasibility and profitability of your business before you launch.

Launch Aids

Before taking the plunge, it can be useful to find out about the various forms of assistance available. There are several support programs and resources available to entrepreneurs in Switzerland.

- Innosuisse : The Swiss innovation promotion agency offers coaching and financial support programs for innovative start-ups.

- Eurostars program : European start-ups can apply for financial support for international collaborative projects.

- Incubators : Incubators such as GENILEM and FONGIT, as well as various Innovation Parks, can provide useful coaching and resources at various stages of a company's life.

Set up your company in Switzerland

Our company start-up offer includes a complete service to help you bring your project to fruition successfully, starting from CHF 690.

Choice of the Legal Form

One of the most important questions when launching your business will be the choice of the legal form. It's essential to make the right choice from the outset, as changing from one form to another can sometimes be complicated.

Opening a Sole Proprietorship

Open a sole proprietorship (RI) in Switzerland is a easiest way to start a business. In fact, no capital contribution is required, and registration in the Commercial Register is optional (up to CHF 100,000 of sales), and the business can be started immediately. However, in order to obtain self-employed status, the entrepreneur must prove that he or she has more than 3 customers. This is necessary in order to contribute to social insurances.

Here are the special features of the sole proprietorship in Switzerland:

- Registration to the Commercial Register is optional but compulsory from CHF 100,000 of sales

- No capital contribution is required

- The company and the entrepreneur have no distinct legal status personality

- The Sole Proprietorship implies an unlimited personal liability to third parties

- It must be founded by one person

- There is an obligation for simple bookkeeping, from CHF 500,000 of sales: accounting according to the CO

- Tax returns are integrated into the private tax return

Opening a Limited Company (SA)

The Limited Company (SA) is one of the most widely used legal forms in Switzerland, particularly suited to medium-sized to large companies. This is the legal form to choose if you are planning a fund raising . A public limited company requires a capital contribution of at least CHF 100,000, released at 50% minimum. Shareholders are only liable for the company's debts up to the amount of their capital contribution. The Limited Company requires more administrative procedures due to its complex structure.

Here are the special features in Switzerland:

- Mandatory RC registration

- Contribution of min. CHF 100,000, of which CHF 50,000 (50%) paid up at the time of creation

- The responsibility of the contractor(s) is limited to the company share capital

- Can be founded by one person

- Obligation to keep your accounting according to the CO

- Tax return is separate for the company

- Anonymity of the shareholders

Opening a Limited Liability Company (Sàrl)

A Limited liability company (Sàrl) is also very popular in Switzerland. It is particularly well suited to small and medium-sized businesses and start-ups. Thanks to its flexibility and capital contribution as low as CHF 20,000, it enables all entrepreneurs to get started easily, while protecting their assets.

The partners are also liable only to the extent of their contribution to the company. However, the anonymity of associates is not preserved, and their names can be consulted at any time in the Commercial Register.

Here are the special features of the LLC:

- Mandatory RC registration

- Contribution of min. CHF 20,000, released at 100%

- The responsibility of the contractor(s) is limited to the company share capital

- Can be founded by one person

- Obligation to keep your accounting according to the CO

- Tax return is separate for the company

- Identity the identity of partners & managers in the RC

Other Legal Forms

In addition to the legal forms listed above, there are other structures in Switzerland, as follows:

- General partnership : legal form in which at least 2 individuals join forces to run a business under a common name. Each partner is jointly and personally liable for the company's debts.

- Cooperative : an entity formed by a group of people or companies sharing a common economic objective. Members cooperate to achieve this objective while maintaining their independence.

- Limited partnership : this structure combines "general" partners (who manage the company and are liable for their personal assets) and "limited" partners (who participate in the capital but whose liability is limited to their contribution).

- Simple partnership : A form of contract used for temporary projects such as joint ventures or specific projects.

Administrative Formalities

To open a company in Switzerland, you'll need to comply with a number of administrative formalities. You can choose to set up your company yourself or through an agent such as a trustee.

Choice of Company Name

You can choose freely the name of your company, whether it's the name of an individual, a description of your activity, or even a creative designation. However, the name must not be already in use by another entity, nor be misleading or contrary to public interest. To check the availability of your name, consult the Central Index of Swiss Trade Reasons and search for the desired name.

The name will be followed by the legal form, such as: "Name of choice" + SA/Sàrl. For an IR: "Name to choose" + Last name or First name.

Opening a Consignment Account

For Limited Companies and LLCs , before registering in the Commercial Register, the founders must open a bank account where the share capital (CHF 100,000 for a LC and CHF 20,000 for a LLC) will be deposited. The bank then issues a certificate confirming the capital deposit.

Drafting By-laws

For Limited Companies and LLCs , the company's articles of association must be drawn up and approved by the founders. These articles specify the company name, the head office, the company purpose, the amount of share capital, and the management methods and governance. The articles of association must be notarized.

Entry in the Commercial Register

Registration with the Commercial Register formalizes the creation of your LC or LLC and gives it a legal status. Registration must be made with the register responsible for the canton where the company has its registered office. The notary submits the articles of association and other documents required for registration. Once registration is complete, the company receives its business identification number (IDE), which is required for all types of administrative procedures.

For a sole proprietorship, there is no need to register with the RC as long as sales do not exceed CHF 100,000 of turnover. However, it is recommended that you register for greater credibility in your business.

Audit Obligation

In Switzerland, certain companies (SA and Sàrl) are required to get a revision of their annual financial statements by an auditor. This obligation depends on the size and structural of the company, as well as number of employees.

A regular revision is required when a company exceeds 2 of the 3 following thresholds in 2 consecutive years:

- Balance sheet total over CHF 20 million

- Sales higher than CHF 40 million

- More 250 employees full-time employees on an annual average.

A limited review is a simplified audit that is compulsory for companies that do not exceed the thresholds for an ordinary audit, but employ more than 10 employees full-time employees. Smaller companies with fewer than 10 full-time employees can opt out of the revision (opting-out).

Insurance

The insurance you need depends on the legal form of your company. If you have a sole proprietorship (or general partnership or limited partnership), you are considered to be self-employed and are primarily responsible for your own pension provision, including AHV and IV. On the other hand, if you have a LC or LLC, you are both an employer and employee, making mandatory most of the social insurances.

Compulsory Insurance

- AVS : AHV (AVS in French) is compulsory for all employees in Switzerland, including the self-employed. Employers are required to pay AVS contributions for their employees, amounting to 8.7% of salary, divided equally between employer and employee.

- LPP : LPP is compulsory for all employees with an annual salary in excess of CHF 22,050. Employers must enroll their employees in a pension fund and contribute to this insurance.

- AAP : Accident insurance in Switzerland is divided into two parts: occupational accident insurance (AAP) and non-occupational accident insurance (AANP). It protects employees against the financial consequences of accidents occurring in the workplace or in everyday life.

Optional Insurance

- Daily allowance insurance : This insurance covers employees' wages in the event of absence due to illness or accident. Although optional, it may be mandatory under certain Collective Labor Agreements (CCTs).

- Professional liability insurance : This insurance covers the costs of damage caused to third parties in the course of your professional activities. It is particularly useful in high-risk sectors such as construction.

- Corporate legal protection : This insurance complements your civil liability coverage by providing assistance in the event of litigation. It protects your company against unforeseen legal costs.

Choice of VAT Registration

Companies with annual sales not exceeding CHF 100,000, and CHF 150,000 for not-for-profit associations and foundations, are not required to register for VAT, although they can do so voluntarily. In addition, certain transactions in Switzerland, such as medical, educational, social, financial, and real estate services, as well as insurance, postal services, and cultural and sporting activities, are exempt of VAT.

Frequently Asked Questions

How long does it take to set up a company in Switzerland?

Setting up a business in Switzerland can take between 2 and 4 weeks on average, once all the necessary documents are ready.

How much does it cost to set up a company in Switzerland?

Setting up a company with Fidulex will cost between CHF 690 and CHF 2,490, depending on the legal form and services chosen.

How do I open a business in Switzerland as a French citizen?

Opening a business as a French citizen or a foreigner requires a director domiciled in Switzerland as manager or partner (with signature), for a LC or LLC. For a Sole Proprietorship, you will need a address of domicile.

Choosing the right legal form

Choosing the right legal form will depend on several things, including:

- Number of partners

- The input budget

- Business risk

- The need for investors

- Capital requirements

What legal form should a medical practice take?

Recommended legal forms for opening a medical practice in Switzerland are the Sàrl and the SA.

What legal form should a restaurant take?

Recommended legal forms for restaurant opening are the Sàrl and the SA. The sole proprietorship (RI) is risky because of its unlimited liability.