Introduction

Owners of real estate in Geneva are subject to certain taxes. Your property, whether occupied or rented, affects your wealth and taxable income.

Understanding how to declare your property, estimate its tax value, manage property income and take advantage of deductions is crucial. If your property is located outside the canton or abroad, it will also have an impact on your taxable income.

Taxes for property owners in Geneva

In Geneva, the fiscal value of the property, determined based on its location, nature, and method of acquisition, is a significant factor in wealth taxation. If the property is occupied by the owner, its income is based on a theoretical rental value; if rented out, the collected rents are subject to taxation. Value-adding renovations, such as major improvements, must also be declared.

In addition to these traditional taxes, Geneva applies a supplementary property tax based on taxable value, with rates varying according to use and the nature of the owner (individual or company). However, some exemptions are possible for properties that meet high energy standards.

1. Wealth tax

In Geneva, real estate owned by proprietors or usufructuaries is included in their taxable wealth through its fiscal value. This value is determined by the tax administration based on the property’s location, nature, and method of acquisition.

For a recently acquired property, the value corresponds to the purchase price, while for an inherited property or one received as a gift, it is based on the evaluation conducted at the time of the event. The fiscal value is periodically reassessed and benefits from a progressive reduction of 4% per year of continuous occupancy, capped at 40%, if the property is used personally or by close relatives.

In the case of rental properties (more than two housing units or commercial spaces), the fiscal value is determined by the capitalization of the annual fiscal rental income. For properties located outside the canton or abroad, the fiscal value is used solely to determine the tax rate applicable within the canton.

2. Income tax

Real estate generates taxable income in Geneva, whether you occupy it or rent it out. If you occupy your property, its income is calculated based on the theoretical rental value, which is indexed annually and determined by factors such as the property’s size, condition, and location.

For rented properties, taxable income corresponds to the rents received, after deducting maintenance expenses and allowable charges. However, renovations that increase the property’s value cannot be deducted as regular expenses. If the property is located in another canton or abroad, the rental income is included to determine the tax rate in Geneva and added to taxable income for federal direct tax purposes.

3. Supplementary property tax

In Geneva, the supplementary real estate tax is a tax levied on real estate located in the canton. This tax is calculated on the basis of the tax value of the property, regardless of where you live or your financial situation. The standard rate is 1‰ for individuals, but it varies for companies, associations or foundations depending on the use and whether or not the asset is for profit (up to 2‰).

Debts on the property or the continuous occupancy allowance are not taken into account for this tax. However, an exemption of 20 years is granted to owners of properties meeting high energy performance standards (HPE or THPE), on presentation of a certificate issued by the relevant authorities.

4. Property gains tax

The real estate gains tax in Geneva applies to the sale of a property if you make a profit, i.e. if the sale price exceeds the purchase price (or the value retained in the event of a gift or inheritance).

Taxable gain represents the difference between the sale price and the purchase price, adjusted for acquisition costs (notary fees, transfer taxes, etc.), value-adding work (renovations that increase the value of the property), and selling expenses (agency commissions, advertising costs).

The rate is regressive, meaning it decreases with the length of time the property is held.

Deductible expenses

In Geneva, property owners can deduct certain expenses to reduce their tax burden. These expenses fall into two main categories: actual expenses and standard deductions. Actual expenses include costs necessary for property maintenance. If no actual expenses are incurred, owners can opt for a standard deduction based on the building's age: 10% of rental income for properties less than 10 years old, and 20% for older properties.

However, no deduction is possible for assets located abroad whose rental value is calculated on a flat-rate basis.

Value-adding renovations

Value-adding renovations refer to upgrades or improvements that increase the value of your property (e.g., extensions, adding a pool or veranda). Unlike maintenance expenses, these works are not deductible from rental income. However, their declaration is mandatory as they affect the property’s fiscal value, which is used for wealth tax and supplementary property tax calculations.

These works increase the fiscal value of the property, which can lead to a rise in wealth tax and supplementary property tax.

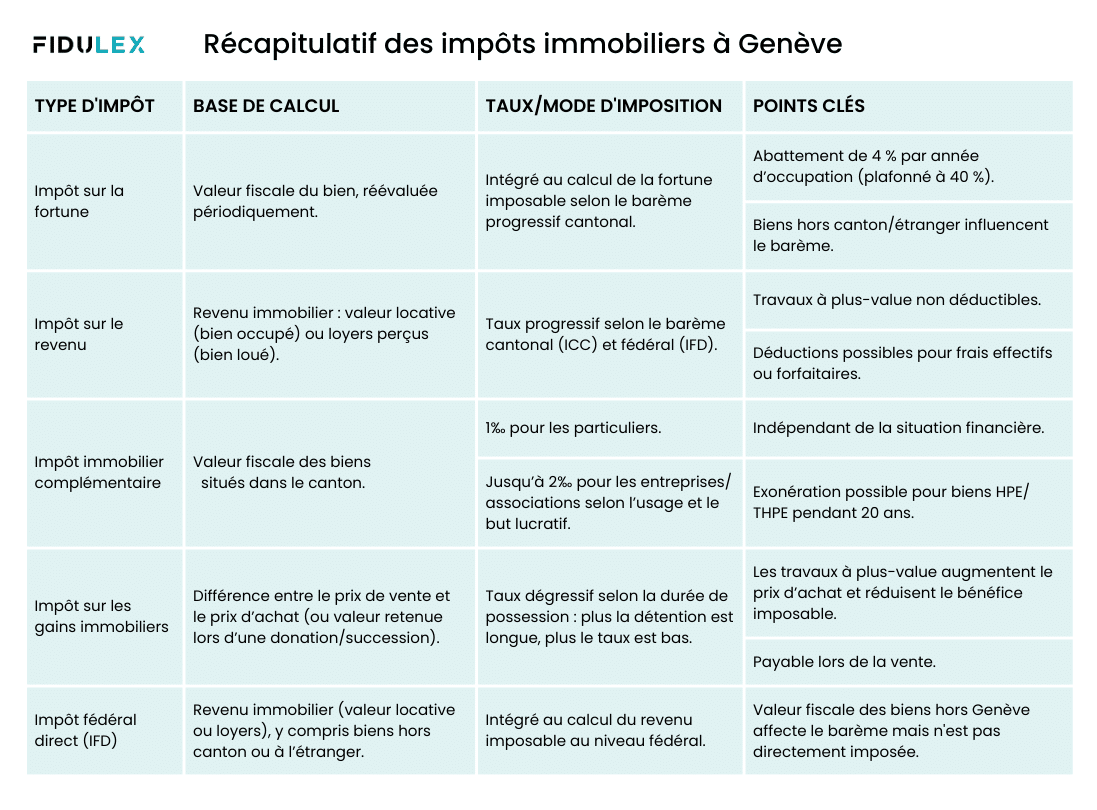

Summary of property taxes in Geneva