The importance of BVG

The professional providenceThe 2nd pillar is a crucial complement to the AVS (1st pillar). Visit employee contributions, These contributions, combined with those from employers, build up a retirement capital over the course of a professional career. These assets are then used to pay a annuity at retirement. At present, the law sets a minimum annuity amount for each franc saved, which ensures a secure retirement. basic income for retirees.

Current problems

The weakness of financial returns and the increase inlife expectancy have jeopardized the financing of pensions in the compulsory part of occupational benefit plans. Pension funds offering the legal minimum or slightly more have been particularly hard hit. In addition, people with low income receive very low or non-existent pensions (if below the threshold) from their pension funds.

Reform measures

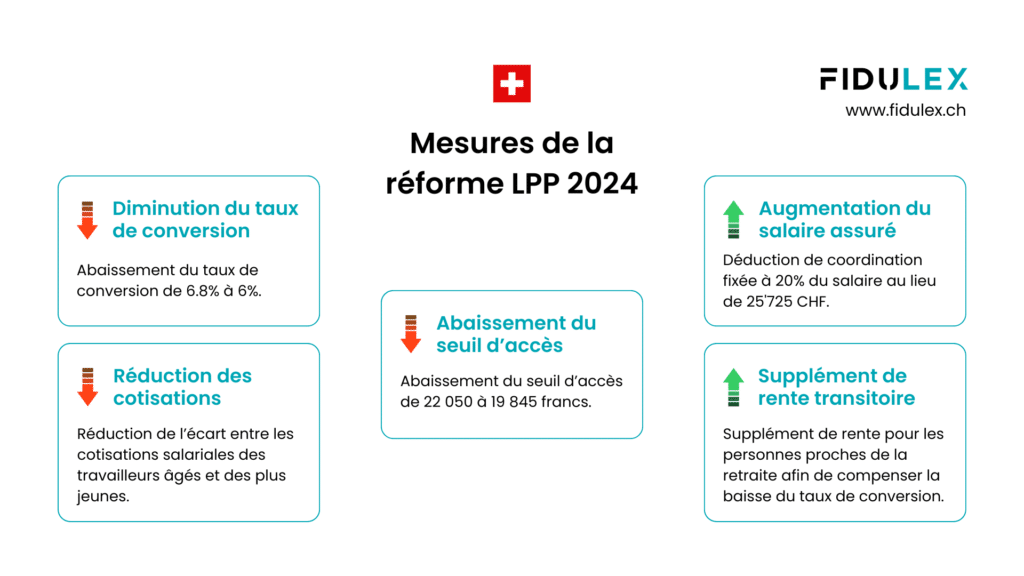

The BVG reform proposes a number of measures to ensure the future financing of pensions and improve coverage for low-income earners:

Lower conversion rate

The conversion rate, which determines the amount of the annual pension, will be reduced by 6.8 % to 6.0 %. For example, on a retirement capital of CHF 100,000, the annual pension will fall from CHF 6,800 to CHF 6,000. From compensatory measures will be put in place to minimize the impact of this reduction on future pensions.

Compensatory measures

The insured salary will be increased by modifying the coordination deduction, which will be set at 20 % of gross salary instead of a fixed amount. This will insure a larger proportion of low wages and increase future pensions.

In addition, a pension supplement will be granted to people nearing retirement, to offset the impact of the changes before their positive effects are felt. This supplement, of up to 200 francs per month, will be financed by compensation funds, as well as employee contributions from all workers and employers.

Improving access to the LPP

To improve access for those on the lowest incomes, the threshold for access to the 2nd pillar will be lowered by 22'050 to CHF 19,845This will enable around 70,000 more people to benefit from occupational pension coverage¹.

¹ Source: FSIO, Pension Reform. Overview of measures. Link to this page: https://www.bsv.admin.ch/bsv/fr/home/assurances-sociales/bv/reformen-und-revisionen/bvg-reform.html#2045915275

Reduced pension credits for older workers

In order to limit the disadvantage of older people on the labour market, their contribution percentage will be reduced. A increase will be observed for 25-34 then decreasing rates with age.

Frequently Asked Questions

What is the reform of the occupational benefit plan (LPP)?

The BVG reform is an initiative aimed at strengthening financing of Switzerland's 2nd pillar pension scheme, to maintain pension levels and improve coverage for part-time and low-income workers. Citizens will vote on this reform on September 22, 2024.

Why do we need to reform our compulsory occupational pension scheme?

The financing of pensions in the compulsory part of the occupational pension scheme is currently insufficient due to low financial returns and increasing life expectancy. The aim of the reform is to guarantee sustainable financing and improve coverage for low-income earners.

How will the pension supplement be financed?

The total cost of the pension supplement is estimated at around 800 million per year. It will be financed by employee and employer contributions, as well as by pension funds.

Who will be affected by the increase in employee contributions?

Employees and their employers who only have compulsory coverage (minimum BVG/LPP) or slightly more, will see their employee contributions rise to increase. This change affects around a third of employees.

Are current retirees affected by the reform?

No, current pensions are not unaffected by the reform. Only those who are still working and contributing to a pension fund will be affected by the proposed changes.

When would the reform come into effect if accepted?

If the reform is accepted in the vote on September 22, 2024, it could come into force in 2026after public consultation on the implementation provisions.