Why Choose Dubai?

In addition to its beauty, Dubai is attractive for a number of reasons, the most important being its significant tax advantages, in particular the absence of tax. In Switzerland, although some cantons have lower rates, in general, we all have to pay taxes such as:

- Income tax

- Company tax

- Income tax

- Tax on inheritance

- Tax on donations

But in Dubai, you won't pay for any of this, subject to certain conditions..

If you are an employee, you will receive your gross salary at the end of each month. Not only will you pay no income tax, but there will be no deductions from your salary because there are no mandatory social security contributions in Dubai.

Before 2023, UAE-based companies were also tax-exempt. However, since last year, Dubai-based companies have been required to pay a corporate tax of 9%, a rate that remains relatively low, as soon as the company makes more than 375,000 AED (about CHF 90,000). You are not concerned by this tax if your company is located in a free zone.

Value-added tax (VAT) is also low in Dubai, sitting at just 5%.

All these tax advantages make Dubai a paradise for employees and entrepreneurs alike. These rates are also attractive for potential investors.

Conditions

However, not everyone can benefit from these tax advantages. To avoid paying taxes, you need to meet certain criteria.

Companies

To be completely exempt of tax in Dubai, your company must not make more than CHF 90,000 in profits. Otherwise, you will be subject to company tax as soon as you exceed this threshold, unless your company is located in a free zone.

This law can be particularly advantageous , if you're just starting up your business, since you won't pay any taxes at the beginning.

Depending on the type of business you want to start, you'll need to factor in other costs, such as any licenses and/or permits you may need. Keep in mind that the price of these remains the same regardless of the profit you make, which is another advantage.

There are three main types of company in Dubai that should interest you. They are as follows:

- Free zone companies

- Mainland companies (Onshore)

- Offshore companies (holding companies)

As its name indicates, a free zone company is situated in a place called a "free zone," where international investors and expatriates are permitted to own businesses. These types of companies have their benefits since free zones are economic zones with their own laws and regulations. This type of company also has its limitations, as a free zone company cannot operate outside a free zone.

You won't be able to work with onshore companies without an intermediary, but opening such a company is generally easier. You will also be exempt from corporate tax.

This is not the case for onshore companies, which have no similar limitations. You're free to do business with any company, whether it's in a free zone or on the mainland.

However, opening and maintaining such a company is often more complicated, especially for entrepreneurs who are not UAE tax residents. What's more, if your company is onshore, you will be subject to the new corporate tax.

Finally, entrepreneurs wishing to benefit from Dubai's tax advantages through a holding company, without carrying out any commercial activity in the UAE.

A holding company is more of a commercial entity, i.e. a company that neither manufactures nor sells products/services, but holds the shares of other companies.

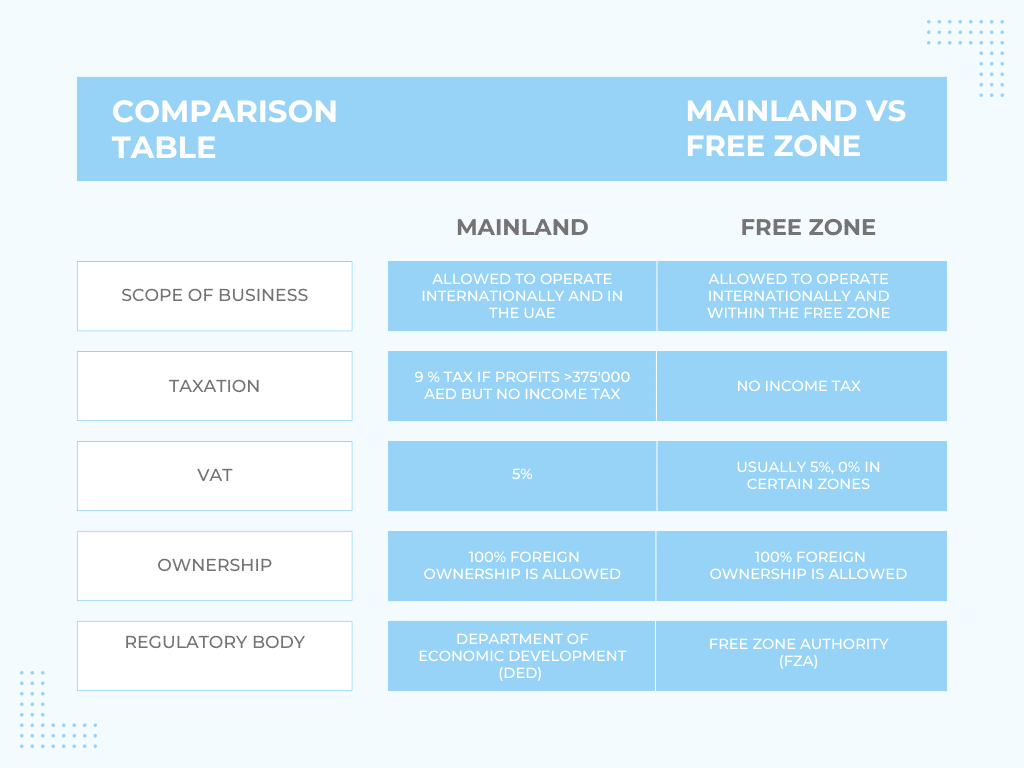

Summary Table

As an Employee

It is also possible to live and work in Dubai as a foreign employee and you will receive your full salary each month.

Is Dubai a tax haven?

Generally, the expression "tax haven" refers to countries or economic zones with many tax advantages, such as very low or non-existent tax rates, particularly for non-residents.

If we follow this definition, then Dubai, in view of the various economic advantages it offers, can be considered a tax haven.

However, unlike other tax havens such as the Cayman Islands, Dubai has been far more cooperative with Europe. Indeed, like Panama, another tax haven, the Cayman Islands have been unwilling to have open communication with the EU. They are therefore blacklisted and generally to be avoided.

Double Taxation Agreement

As we have seen, the UAE has been open to trade with the EU. In 2022, Switzerland concluded an agreement modifying the double taxation agreement.

As with French cross-border commuters, this protocol was made to avoid double taxation in terms of income tax This will prevent the same income from being taxed in two different tax jurisdictions. Thus, this agreement ensures fair taxation of income while combatting tax evasion.

Conclusion

As we have seen, setting up a business in Dubai has a number of advantages. tax benefits which make the UAE an ideal location for economic growth.

Frequently Asked Questions

What taxes do I have to pay in Dubai as an employee?

You are not taxed if you are an individual working in Dubai; you will receive your full salary.

Do I have to pay corporate tax as a company director?

You have to pay corporate income tax of 9%, as soon as your company generates more than CHF 90,000 profit unless the latter is in a free zone.

Is Dubai a tax haven?

Dubai is not considered a tax haven as it is in open to work hand in hand with the EU.

What type of company can I set up in Dubai?

You can set up a free zone, onshore, or offshore company.